Real Estate Agent - Financial Statements Workbook

Use this Excel or Google Sheets template to calculate and easily file your Schedule-C.

Workbook includes:

Financial Summary Dashboard (not available in Google Sheets)

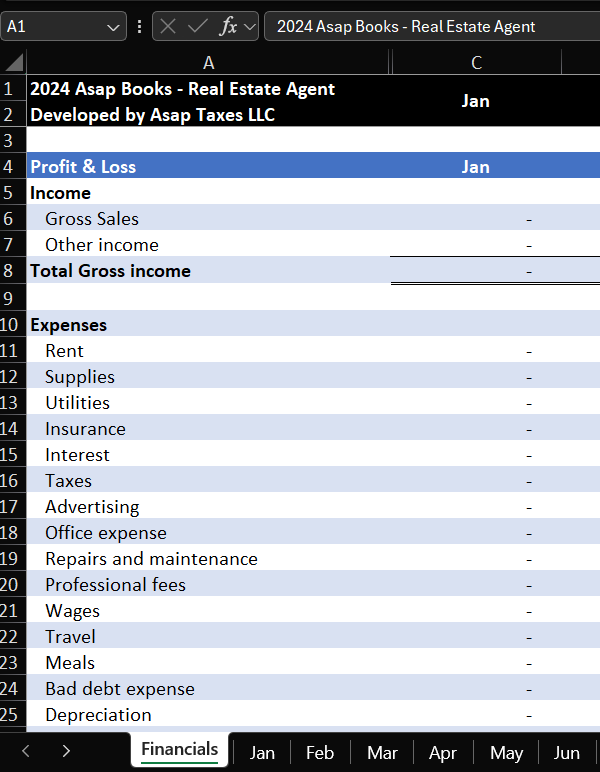

Profit & Loss Statement

Balance Sheet

Instructions to use the calculator in 4 easy steps:

Step 1: If you will use Google Sheets, the link is provided within the file. To begin using the calculator make a copy of the Google Sheets. Go to File->Make a copy.

Step 2: Go to the month of financial activity you want to record.

Step 3: In column B, Select type of payment, Cash in or cash out: Check, Wire, ACH, Debit card OR Credit Card to record expenses through your credit card. For accrual basis, invoice and bills are available.

Step 4: In columns C-F, (C) enter the date, (D) description, (E) choose account from list = income or expense, and (F) most importantly the amount (enter as negative for expenses - money leaving or positive for income - money coming in).

Do not edit the cells in the “Financials” tab. Those are all formulas.

Bookkeeping tool only.

Tax filing not included.

Use this Excel or Google Sheets template to calculate and easily file your Schedule-C.

Workbook includes:

Financial Summary Dashboard (not available in Google Sheets)

Profit & Loss Statement

Balance Sheet

Instructions to use the calculator in 4 easy steps:

Step 1: If you will use Google Sheets, the link is provided within the file. To begin using the calculator make a copy of the Google Sheets. Go to File->Make a copy.

Step 2: Go to the month of financial activity you want to record.

Step 3: In column B, Select type of payment, Cash in or cash out: Check, Wire, ACH, Debit card OR Credit Card to record expenses through your credit card. For accrual basis, invoice and bills are available.

Step 4: In columns C-F, (C) enter the date, (D) description, (E) choose account from list = income or expense, and (F) most importantly the amount (enter as negative for expenses - money leaving or positive for income - money coming in).

Do not edit the cells in the “Financials” tab. Those are all formulas.

Bookkeeping tool only.

Tax filing not included.

Use this Excel or Google Sheets template to calculate and easily file your Schedule-C.

Workbook includes:

Financial Summary Dashboard (not available in Google Sheets)

Profit & Loss Statement

Balance Sheet

Instructions to use the calculator in 4 easy steps:

Step 1: If you will use Google Sheets, the link is provided within the file. To begin using the calculator make a copy of the Google Sheets. Go to File->Make a copy.

Step 2: Go to the month of financial activity you want to record.

Step 3: In column B, Select type of payment, Cash in or cash out: Check, Wire, ACH, Debit card OR Credit Card to record expenses through your credit card. For accrual basis, invoice and bills are available.

Step 4: In columns C-F, (C) enter the date, (D) description, (E) choose account from list = income or expense, and (F) most importantly the amount (enter as negative for expenses - money leaving or positive for income - money coming in).

Do not edit the cells in the “Financials” tab. Those are all formulas.

Bookkeeping tool only.

Tax filing not included.